Apparel Retail Issuers in Indonesia: Set Up Strategies to Survive When Performance is Sluggish

The performance of four apparel retail issuers in Indonesia was still shaken by the effects of the COVID-19 pandemic in the first quarter of 2021. Three of them recorded a decline in revenue of more than 20% compared to the first quarter of last year (year-on-year/yoy). PT Ramayana Lestari Sentosa Tbk. (RALS) holds the record […]

Insight Langit Biru

The performance of four apparel retail issuers in Indonesia was still shaken by the effects of the COVID-19 pandemic in the first quarter of 2021. Three of them recorded a decline in revenue of more than 20% compared to the first quarter of last year (year-on-year/yoy).

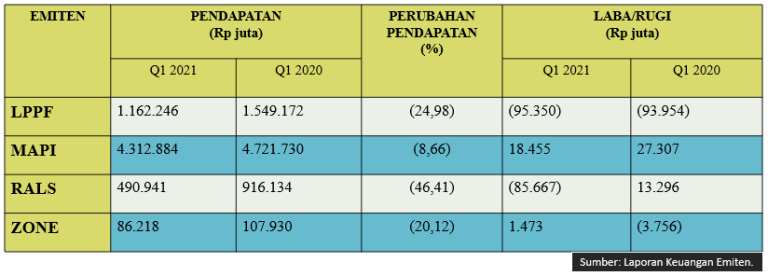

Data on the income and profit/loss of apparel retail issuers for Q1 2021/Q1 2020.

PT Ramayana Lestari Sentosa Tbk. (RALS) holds the record with the decline in income reached 46.41%. Next, PT Matahari Department Store Tbk. (LPPF) which recorded a decline in revenue of 25% and PT Mega Perintis Tbk. (ZONE) with revenues that fell 20.12%.

Only PT Mitra Adiperkasa Tbk. (MAPI) whose income fell by a single digit, namely 8.66%. The manager of the Zara and Marks & Spencer brands was even able to increase net profit by 222.91% yoy during the first three months of this year. However, this net profit was not due to operational performance, but due to a decrease in foreign exchange losses and other losses.

Mega Perintis, the company that operates Manzone outlets, also recorded a profit in the first quarter of 2021 because it was able to reduce selling expenses as well as general and administrative expenses.

The implementation of Community Activity Restrictions (PPKM) has an impact on the number of customer visits and operational hours that have not returned to the pre-pandemic period. One of the conditions experienced by LPPF.

LPPF’s same store sales growth (SSSG) was minus 22.3% and the company’s net loss reached Rp95.35 billion. LPPF operates 147 outlets.

The decline in the income of clothing retail issuers can be read as a result of the weakening of people’s purchasing power.

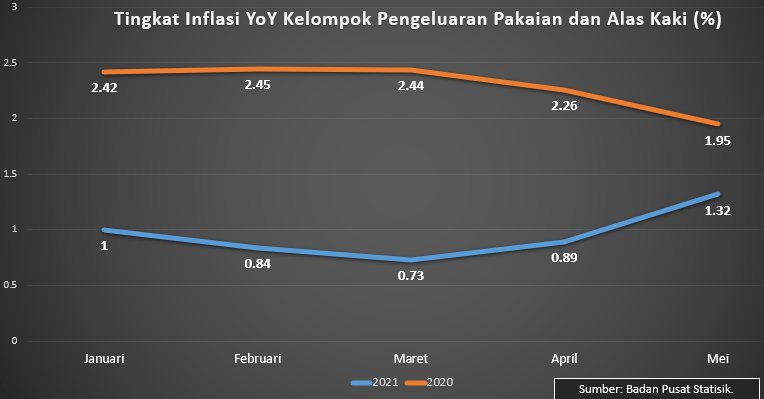

Data on the inflation rate for clothing and footwear expenditure groups.

Central Bureau of Statistics of Indonesia data shows that the year-on-year inflation rate for the clothing and footwear expenditure group in January-March 2021 is lower than the inflation rate for the same group in January-March 2020.

In the first three months of 2020, the yoy inflation rate for the clothing and footwear expenditure group averaged 2.43%. However, in the first three months of this year, the average yoy inflation rate for this group was lower, which was at 0.85%.

Survival Effort

Apparel retail issuers agree that the COVID-19 pandemic has had a major impact on the business operations. The pandemic resulted in negative economic growth and reduced consumer purchasing power.

In addition, the policy of limiting social activities has an impact on less customer visits to stores. Issuers estimate that this effect will continue for an indefinite period in the future.

The following summarizes the efforts of clothing retail issuers to survive in a situation full of uncertainty. This summary is sourced from the issuer’s financial reports in the first quarter of 2021 and reports in the mass media.

LPPF

- Increase liquidity by extending CIMB Niaga’s loan facility. The Group has access to a Rp700 billion loan facility until December 18, 2021 and a Rp1 trillion loan facility until January 31, 2022.

- Ensuring adequate liquidity with a bank loan of Rp480 billion at the end of March 2021.

- Negotiations with the lessor regarding the reduction of the rental fee.

- Low capital outlay in the form of only allowing urgent activities and approved projects.

- Build more targeted marketing with a return-on-investment approach.

- Get additional new bazaar locations.

- Plan to close 13 outlets in 2021.

MAPI

- Maximizing employee efficiency and productivity.

- Business development focus on brands that can deliver more results.

- Online and omni-channel business development.

- Limiting the amount of capital expenditure to open new outlets.

- Cost efficiency.

- Loan restructuring from Standard Chartered Bank, Jakarta, with a maximum value of US$60 million.

RALS

- RALS stopped the operations in two outlets and operating in two new outlets.

- Plan to open five new outlets in 2021.

ZONE

- Continue to thoroughly monitor the operations, liquidity, and resources.

- Boost selling through online platforms.

Writer: Gloria Natalia Dolorosa