Enthusiasm for Stock Trading is Still Solid Despite the Shrinking JCI

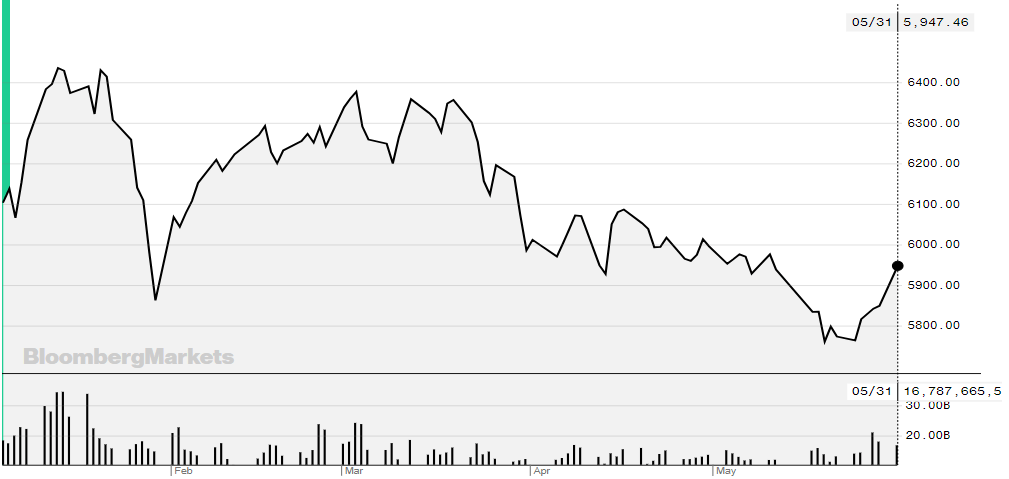

The Composite Stock Price Index (JCI) since early January 2021 to May 31, 2021 has fluctuated with a downward trend. On January 4, 2021, the JCI closed at 6,104.90, then on May 31, 2021, it closed at 5,947.47. JCI has dropped 157 points. Bloomberg data show JCI return minus 0.53% ytd. So far this year, […]

Insight Langit Biru

The Composite Stock Price Index (JCI) since early January 2021 to May 31, 2021 has fluctuated with a downward trend. On January 4, 2021, the JCI closed at 6,104.90, then on May 31, 2021, it closed at 5,947.47.

JCI has dropped 157 points. Bloomberg data show JCI return minus 0.53% ytd.

- 11 Bank Biayai Proyek Tol Serang-Panimbang Rp6 Triliun

- PTPP Hingga Mei 2021 Raih Kontrak Baru Rp6,7 Triliun

- Rilis Rapid Fire, MNC Studios Milik Hary Tanoe Gandeng Pengembang Game Korea

- Anies Baswedan Tunggu Titah Jokowi untuk Tarik Rem Darurat hingga Lockdown

- IPO Akhir Juni 2021, Era Graharealty Dapat Kode Saham IPAC

So far this year, the JCI has been at the highest position of 6,435.32 on January 13 and the lowest position at 5,760.58 on May 19.

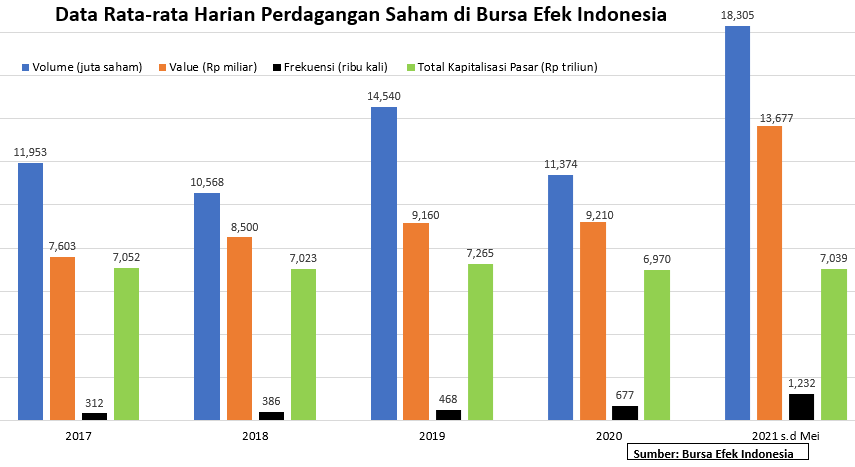

Although the movement of the JCI is somewhat shrunken, the average volume and value of daily stock trading throughout the current year has been higher for the last 5 years.

It cannot be compared with the annual record, but this comparison provides an illustration of the enthusiasm of investors to trade on the Indonesia Stock Exchange.

During the first five months of 2021, the average daily volume reached 18.3 billion shares and the average daily value was Rp13.67 trillion.

Meanwhile, the average trading frequency reached 1.23 million times, much higher in the last 5 years. The market capitalization formed as of May 31, 2021 was Rp7,039 trillion.

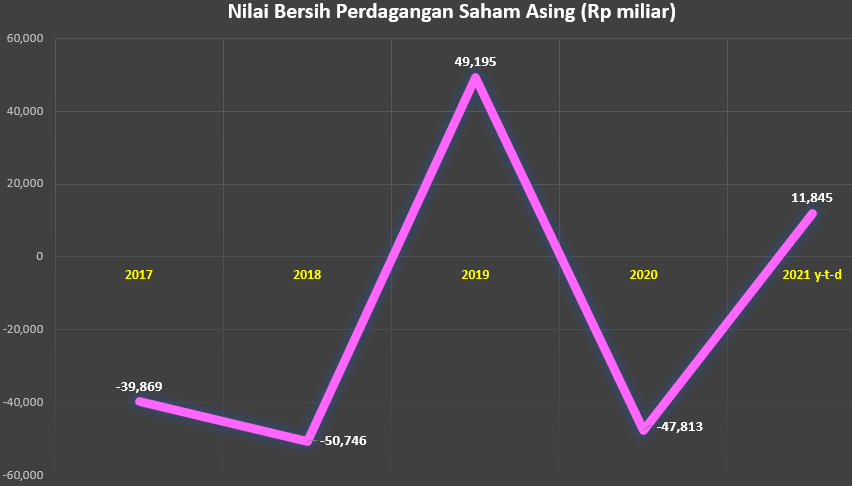

Throughout 2021, the net value of foreign investors reached Rp11.84 trillion. This figure at least shows that there is still capital inflow of foreign investors to Indonesia, which can be interpreted as the confidence of foreign investors in the stock trading market in Indonesia.

This assumption is also strengthened when comparing the net value of foreign investors in 2019 which was minus Rp47.81 trillion.

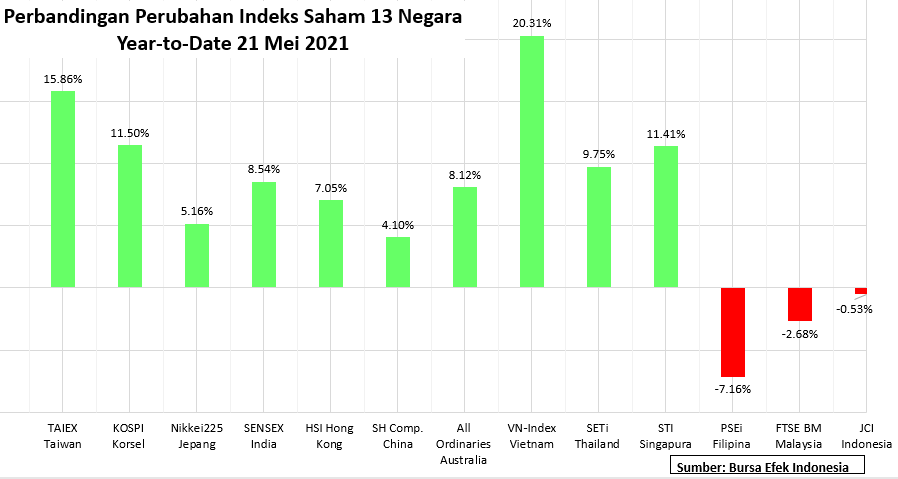

Of the countries in Southeast Asia, the JCI was quite down with a decline of 0.53% during the first five months of 2021. STI Singapore recorded a growth of 11.41% and Vietnam’s VN-Index grew by 20.31%.

The decline in the JCI is more evident when compared to countries in the Asia Pacific region. Indices in Australia, China, Hong Kong, India, Japan, South Korea and Taiwan were able to grow above 4%.

Writer: Gloria Natalia Dolorosa