IDXTECHNO Soars 873 Percent, Here is a List of Technology Stocks with Skyrocketing Prices

The technology sector index went the fastest compared to 11 other sectoral indices listed on the Indonesia Stock Exchange. From the beginning of 2021 to June 17, 2021, the technology sector index (IDXTECHNO) has shot up 873.28%. The index, which contains 17 technology sector stocks, surpassed the increase in both the infrastructure index and the […]

Insight Langit Biru

The technology sector index went the fastest compared to 11 other sectoral indices listed on the Indonesia Stock Exchange. From the beginning of 2021 to June 17, 2021, the technology sector index (IDXTECHNO) has shot up 873.28%.

The index, which contains 17 technology sector stocks, surpassed the increase in both the infrastructure index and the transportation and logistics index, which was still below 10%.

Based on reports in the mass media, a number of analysts believe that the rapid increase in stock prices of technology issuers was triggered by the increasing use of digital technology since the COVID-19 pandemic.

- 11 Bank Biayai Proyek Tol Serang-Panimbang Rp6 Triliun

- PTPP Hingga Mei 2021 Raih Kontrak Baru Rp6,7 Triliun

- Rilis Rapid Fire, MNC Studios Milik Hary Tanoe Gandeng Pengembang Game Korea

- Anies Baswedan Tunggu Titah Jokowi untuk Tarik Rem Darurat hingga Lockdown

- IPO Akhir Juni 2021, Era Graharealty Dapat Kode Saham IPAC

The increasingly massive use of digital technology and new opportunities in the digital business have the potential to increase the income of technology issuers.

In addition, GoTo and Bukalapak’s IPO plans also spurred the share price of technology issuers to increase.

Of the 17 stocks in IDXTECHNO, eight of them posted share price increases of more than 100% throughout almost the first half of this year. Five other stocks recorded gains varying from 10% to 84%, two stocks were suspended, and two other stocks fell.

Changes in the stock price of technology issuers in year-to-date IDXTECHNO 17 June 2021.

PT DCI Indonesia Tbk. (DCII), the data center company owned by Otto Toto Sugiri, led the pace of gains. When it was first listed on the Indonesia Stock Exchange (IDX) on January 6, 2021, DCII was at the level of Rp525.

Almost six months later, DCII rocketed 11.138% to a position of Rp59,000 as of June 17, 2021, shifting the high share price of PT Gudang Garam Tbk. (GGRM) which costs Rp36,025.

As a result, DCII became the most expensive stock on the IDX. Its market capitalization has reached Rp140 trillion, although it is not enough to match the market capitalization of PT Bank Central Asia Tbk. (BBCA) which has reached Rp772 trillion.

The sharp increase in DCII’s share price is allegedly due to the buying action of DCII’s shares by Indofood Group owner Anthoni Salim on March 31, 2021. He bought 192.74 million DCII shares at a price of Rp5,277 per share. The total purchase value is around Rp1.01 trillion.

Anthoni Salim’s share ownership in DCII increased to 11.12% from the previous 3.03% through this transaction.

- 11 Bank Biayai Proyek Tol Serang-Panimbang Rp6 Triliun

- PTPP Hingga Mei 2021 Raih Kontrak Baru Rp6,7 Triliun

- Rilis Rapid Fire, MNC Studios Milik Hary Tanoe Gandeng Pengembang Game Korea

- Anies Baswedan Tunggu Titah Jokowi untuk Tarik Rem Darurat hingga Lockdown

- IPO Akhir Juni 2021, Era Graharealty Dapat Kode Saham IPAC

Far below DCII, the shares of PT Multipolar Technology Tbk. (MLPT) also increased sharply by 643.06%, throughout the current year until on June 17, 2021 it touched Rp5,350.

The sharp increase in the shares of the company owned by the Riady family began in early June. In just two weeks the price of MLPT jumped 259%.

Furthermore, PT Kioson Komersial Indonesia Tbk. (KIOS) incised a price increase of up to 525.89% to the position of Rp870. KIOS is a software and hardware platform provider company for MSMEs through a partnership system called Kioson Cash Point (KCP).

Not much different from KIOS, the share price of PT Digital Mediatama Maxima Tbk. (DMMX) jumped 454.62% so far this year to Rp1,320. DMMX began to increase sharply since mid-May 2021.

Meanwhile, the deepest decline occurred at PT Sat Nusapersada Tbk. (PTSN). From the beginning of the year until June 17, 2021, the price of PTSN fell 6.84% to Rp218.

Comparison of stock prices of technology issuers on January 4, 2021 and June 17, 2021.

Meanwhile, the shares of PT Northcliff Citranusa Indonesia Tbk. (SKYB) was suspended until February 17, 2022 by the IDX authority considering the potential for delisting.

The IDX also imposed a temporary suspension of trading on shares of PT Envy Technologies Indonesia Tbk. (ENVY) embarked in session II on December 1, 2020.

Eight of the 17 technology stocks are in the price range of Rp1,000 to Rp5,000 on trading on June 17, 2021. DCII leads at a premium price of Rp59,000 per share. Meanwhile, seven other stocks are at the level of Rp1,000 and below, excluding ENVY and SKYB.

Operational Performance

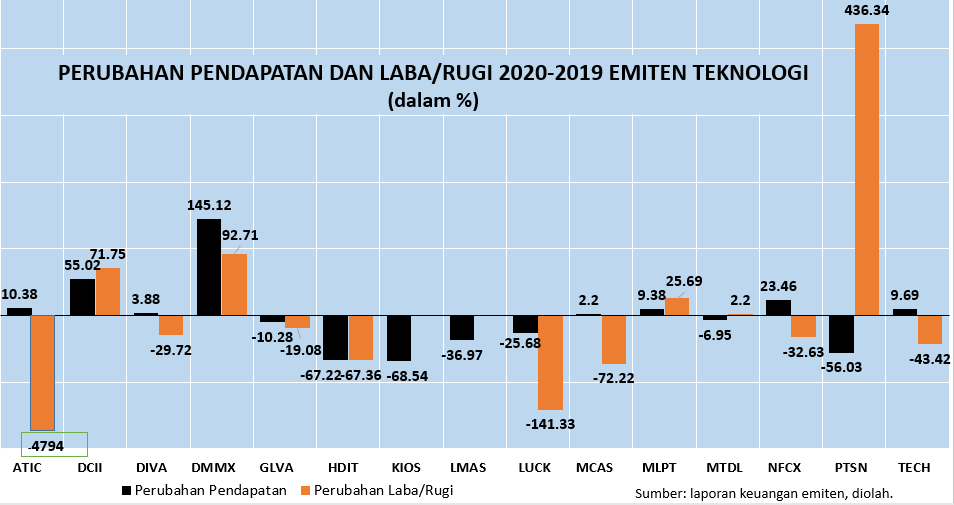

In terms of operational performance, the income of eight of the 17 technology issuers increased throughout 2020 compared to 2019 (year-on-year/yoy). The largest increase in revenue occurred in Digital Mediatama Maxima (DMMX), amounting to 145.12% yoy. Meanwhile, its net profit increased by 92.71%.

Changes in income and profit/loss for technology issuers 2020-2019.

DMMX is a digital cloud-based ad management services company and telecommunications. DMMX, along with three other technology issuers, namely PT M Cash Integration (MCAS), PT NFC Indonesia (NFCX), and PT Distribution Voucher Nusantara (DIVA) are entities under common control.

The name is Suryandy Jahya, the founder of PT Kresna Graha Investama Tbk. (KREN), is in the row of commissioners and directors of the four companies.

In the midst of the pandemic, DMMX proved to be still expanding by building a joint venture. He collaborated with Rans Entertainment which is owned by artist, Raffi Ahmad. Together, they established PT DMMX Rans Digital, a digital social media platform management company with an authorized capital of Rp900 million.

Not only DMMX, three companies under common control also posted an increase in revenue in 2020.

In detail, the revenue of MCAS (the main distributor of merchandise and management consulting services in the field of information technology) rose 2.2%, the revenue of NFCX (the sales of digital products) increased by 23.46%, and DIVA (the sales of digital products, payment solutions and online-to-offline services platforms) rose 3.88%. However, only DMMX posted an increase in net profit.

- 11 Bank Biayai Proyek Tol Serang-Panimbang Rp6 Triliun

- PTPP Hingga Mei 2021 Raih Kontrak Baru Rp6,7 Triliun

- Rilis Rapid Fire, MNC Studios Milik Hary Tanoe Gandeng Pengembang Game Korea

- Anies Baswedan Tunggu Titah Jokowi untuk Tarik Rem Darurat hingga Lockdown

- IPO Akhir Juni 2021, Era Graharealty Dapat Kode Saham IPAC

In addition to DMMX, two technology issuers were able to increase revenue and net profit simultaneously in 2020. They are PT DCI Indonesia (DCII) and PT Multipolar Technology (MLPT).

DCII’s revenue in 2020 increased 55% yoy to Rp759 billion and net profit increased 71.75% to Rp183.14 billion.

DCII is engaged in the industry of providing hosting activities and other activities such as data processing services, web-hosting, streaming, application hosting, and cloud computing storage. Its data center is located in Bekasi Regency, West Java.

In its financial report, DCII management believes that the COVID-19 pandemic does not have a significant impact on the company’s operations.

Meanwhile, MLPT, a telecommunications services and information technology company owned by the Riady family, achieved an increase in revenue in 2020 by 9.38% yoy to Rp2.69 trillion. The increase in net profit reached 25.69%, driven by, among other things, gains from foreign exchange differences as well as gains from disposal of fixed assets.

Meanwhile, the highest increase in net profit in 2020 among technology issuers was held by Sat Nusapersada (PTSN). The company in the electronics assembly business sector gained a 436.34% increase in net profit due to foreign exchange gains.

Writer: Gloria Natalia Dolorosa