Investment Loss is Deemed Corruption (Serial 1): Social Security Agency Strategy to Avoid Unrealized Loss

JAKARTA – The Social Security Agency of Indonesia plans to retreat from the stock market to avoid the risk of unrealized loss on investments in stocks and mutual funds. The Attorney General’s Office first revealed the allegation of unrealized loss when conducting an examination of Social Security Agency (BPJS Ketenagakerjaan). However, Deputy Attorney General for […]

Insight Langit Biru

JAKARTA – The Social Security Agency of Indonesia plans to retreat from the stock market to avoid the risk of unrealized loss on investments in stocks and mutual funds.

The Attorney General’s Office first revealed the allegation of unrealized loss when conducting an examination of Social Security Agency (BPJS Ketenagakerjaan).

- 11 Bank Biayai Proyek Tol Serang-Panimbang Rp6 Triliun

- PTPP Hingga Mei 2021 Raih Kontrak Baru Rp6,7 Triliun

- Rilis Rapid Fire, MNC Studios Milik Hary Tanoe Gandeng Pengembang Game Korea

- Anies Baswedan Tunggu Titah Jokowi untuk Tarik Rem Darurat hingga Lockdown

- IPO Akhir Juni 2021, Era Graharealty Dapat Kode Saham IPAC

However, Deputy Attorney General for Special Crimes, Febrie Adriansyah, claimed that investigators find it difficult to determine the state’s losses on investment management of Social Security Agency.

“So, for the Social Security Agency and Pelindo II cases, the obstacles are still the same, it could be because it is limited to calculating business risks or there is, in fact, a criminal act,” Febrie said in a press conference, Wednesday, March 24, 2021.

For information, unrealized loss can be interpreted as a decrease in the value of investment assets due to fluctuations in the capital market.

Realizing that stock portfolios and mutual funds pose a big risk in the midst of fluctuations in the capital market, Managing Director of Social Security Agency, Anggoro Eko Cahyo, will reallocate the investment composition to avoid unrealized losses in the capital market.

Anggoro added that the stock of Social Security Agency reached 17% while mutual fund reached 8% of the total investment fund of Rp486.38 trillion. To put it another way, the fund placed by Social Security Agency in stocks and mutual funds were recorded at Rp82.68 trillion and Rp38.9 trillion.

The plan to reallocate stock portfolios and mutual funds was pursued after the Old Day Security (JHT) program ran into deficit from 2018 to February 2021. The JHT fund adequacy ratio continued to shrink from 96.6% in 2018 to 95.2% in February 2021.

“We can make changes from stocks and mutual funds to bonds or direct investment. So that we will slowly recompose existing assets to minimize the current market risk,” said Anggoro in front of members of Commission IX of the House of Representatives (DPR), March 30, 2021.

Different Risk Perception of the New CEO

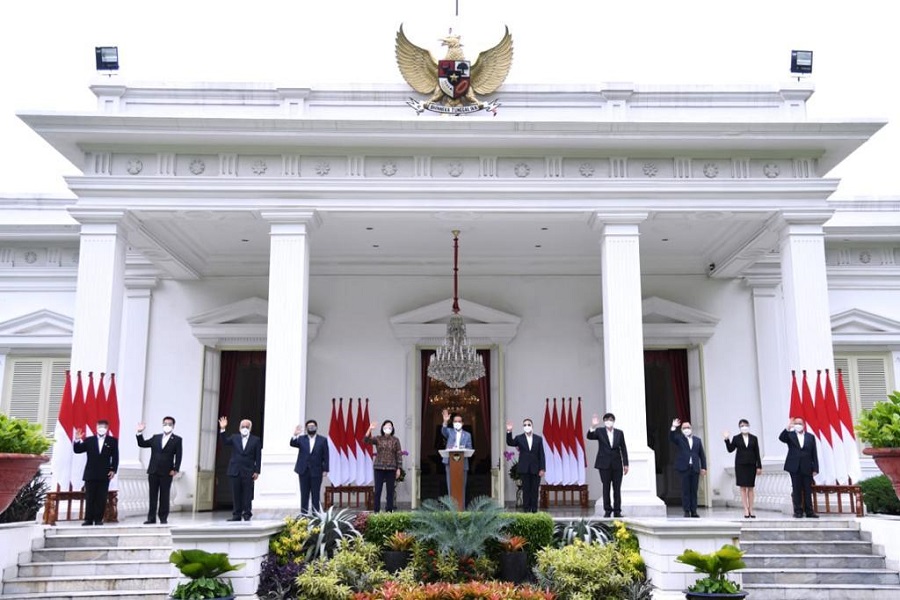

Pelantikan dewan pengawas dan direksi BPJS Kesehatan dan BPJS Ketenagakerjaan oleh Presiden Joko Widodo / Setneg.go.id

Head of Research Creative Trading System, Argha Jonathan Karo Karo, stated the plan to reallocate stock investment and mutual funds of Social Security Agency was influenced by background of the new CEO of Social Security Agency. The new CEO had a career background in banking sector.

“He is a new CEO. His view on stock portfolios of Social Security Agency that does not match the return distinct to what he understood as a banker,” said Jonathan in a virtual discussion held by the Indonesia Stock Exchange (IDX), Tuesday, April 13, 2021.

Anggoro Eko Cahyo indeed has had a lengthy career in banking, specifically at PT Bank Negara Negara Indonesia Tbk. or BNI. He has held strategic positions at BNI, including Consumer Director from 2015 to 2018, Director of Finance from 2018 to 2020, and Deputy Director from 2019 to 2020.

- 11 Bank Biayai Proyek Tol Serang-Panimbang Rp6 Triliun

- PTPP Hingga Mei 2021 Raih Kontrak Baru Rp6,7 Triliun

- Rilis Rapid Fire, MNC Studios Milik Hary Tanoe Gandeng Pengembang Game Korea

- Anies Baswedan Tunggu Titah Jokowi untuk Tarik Rem Darurat hingga Lockdown

- IPO Akhir Juni 2021, Era Graharealty Dapat Kode Saham IPAC

Jonathan also saw Managing Director Anggoro’s move to reveal the reallocation plan shook the Indonesian capital market.

“However, someone has to buy a share sale, but why was it delivered first rather than after. The execution was wrong, but the principle was correct,” said Jonathan.

Social Security Agency’s Portfolio

Pekerja mensterilkan kembali bilik yang digunakan Peserta BP Jamsostek untuk melakukan klaim melalui Layanan Tanpa Kontak Fisik (Lapak Asik) di kantor Cabang Jakarta Menara Jamsostek, Jakarta, Jum’at, 10 Juli 2020. Seiring dengan meningkatnya gelombang pemutusan hubungan kerja di tengah pandemi Covid-19, klaim BPJS Ketenagakerjaan turut melonjak. Pencairan tabungan di BP Jamsostek menjadi alternatif untuk mendukung daya beli pekerja yang tergerus. Sementara dalam rangka adaptasi kebiasaan baru dan untuk memutus penyebaran virus corona, BP Jamsostek telah menerapkan protokol pelayanan secara daring dan tanpa pertemuan secara fisik. Foto: Ismail Pohan/TrenAsia

BPJS Ketenagakerjaan is known to lay five stock portfolios of related parties or in State-Owned Enterprises (BUMN) issuers, namely PT Aneka Tambang Tbk (ANTM) with 150 million units and Perusahaan Gas Negara Tbk (PGAS) with 86.9 million units.

Then there are PT Telkom Indonesia (Persero) Tbk (TLKM), PT Bank Rakyat Indonesia (Persero) Tbk (BBRI), and PT Krakatau Steel Tbk (KRAS) with 46.9 million, 46.6 million, and 46.5 million units each.

The other BPJS Ketenagakerjaan stock portfolios are placed in PT Kalbe Farma Tbk (KLBF) totaling 60 million units, Perusahaan Perkebunan London Sumatra Indonesia Tbk (LSIP) with 34 million units, and PT Astra International Tbk (ASII) with 26 million units.

Then PT Salim Ivomas Pratama Tbk (SIMP) and PT Vale Indonesia Tbk (INCO) reached 25 million and 23 million units, respectively.

“The percentage of stock portfolio can be reduced starting from 2021 by not providing the monthly premium funds received by social security agency to the stock exchange. This can be a smoother step for Social Security Agency to reduce its stock portfolio,” said Jonathan.

- 11 Bank Biayai Proyek Tol Serang-Panimbang Rp6 Triliun

- PTPP Hingga Mei 2021 Raih Kontrak Baru Rp6,7 Triliun

- Rilis Rapid Fire, MNC Studios Milik Hary Tanoe Gandeng Pengembang Game Korea

- Anies Baswedan Tunggu Titah Jokowi untuk Tarik Rem Darurat hingga Lockdown

- IPO Akhir Juni 2021, Era Graharealty Dapat Kode Saham IPAC

Director of Investment Development of Social Security Agency, Edwin Ridwan, clarified that larger investment allocation will be aimed at ownership of debt securities. He also revealed that Social Security Agency’s plan to reduce its stock portfolio is the effect of the COVID-19 pandemic.

“The condition of the capital market is heavily influenced by global sentiment and the negative impact of the COVID-19 pandemic, which has triggered increased volatility,” claimed Edwin in a short message to TrenAsia.com, Wednesday, April 14, 2021.

However, Edwin has not been able to reveal the details of the plan.

Deputy Director for Public Relations and Intermediary Affairs, Irvansyah Utoh Banja, was also reluctant to comment on the plan to withdraw investment in shares or reallocation of investment to debt securities.

Ready to inject funds into INA

Presiden Joko Widodo memperkenalkan figur-figur yang tergabung sebagai anggota Dewan Pengawas dan Dewan Direktur Lembaga Pengelola Investasi (LPI) yang bernama Indonesia Investment Authority (INA) pada Selasa, 16 Februari 2021. / Setneg.go.id

Edwin said the adjustment intends to optimize returns in the long run. The investment fund allocation will be aimed at Government Securities (SBN), corporate bond, and cooperation with the Indonesia Investment Authority (INA).

“Adjustments to the investment portfolio are carried out gradually over the long term, by increasing the allocation of debt securities, both SBN and corporate bond that meet the requirements, and optimizing direct investment,” Edwin added.

The investment funds for INA will come from the Old Day Security (JHT) and Pension Security (JP) programs. The injection of Social Security Agency funds for INA can reach Rp64.6 trillion.

- 11 Bank Biayai Proyek Tol Serang-Panimbang Rp6 Triliun

- PTPP Hingga Mei 2021 Raih Kontrak Baru Rp6,7 Triliun

- Rilis Rapid Fire, MNC Studios Milik Hary Tanoe Gandeng Pengembang Game Korea

- Anies Baswedan Tunggu Titah Jokowi untuk Tarik Rem Darurat hingga Lockdown

- IPO Akhir Juni 2021, Era Graharealty Dapat Kode Saham IPAC

The reason is, based on the financial statements of the company in 2019, the amount of revenue of Social Security Agency from these two programs reached Rp64.6 trillion.

The JHT program revenue in 2019 reached Rp47.42 trillion, down from the previous year which amounted to Rp42.69 trillion. Meanwhile, the JP program has increased from Rp14.86 trillion in 2018 to Rp17.18 trillion in 2019.

“Every investment activity carried out has also gone through a comprehensive fundamental, technical, risk management and compliance review process,” claimed Edwin.

This article is a series of special reports that will be continued in the next issue entitled “Investment Loss is Deemed Corruption.”

Writer: Muhamad Arfan Septiawan

Editor: Sukirno