Lippo’s MPPA Shares Have Boosted by 602.13% Since Temasek Joined

JAKARTA – The output of shares of retail issuers owned by the Lippo Group, PT Matahari Putra Prima Tbk (MPPA), has continued to rise following news of Anderson Investments Pte Ltd (Anderson) acquiring some of the company’s shares. Anderson, a Temasek Holdings Singapore business entity, took over 1,402,947,000 shares or approximately 18.63% of MPPA’s shares […]

Insight Langit Biru

JAKARTA – The output of shares of retail issuers owned by the Lippo Group, PT Matahari Putra Prima Tbk (MPPA), has continued to rise following news of Anderson Investments Pte Ltd (Anderson) acquiring some of the company’s shares.

Anderson, a Temasek Holdings Singapore business entity, took over 1,402,947,000 shares or approximately 18.63% of MPPA’s shares from Prime Star Investment Pte Ltd (PSI). This is in relation to PSI’s responsibilities for the issuance of exchangeable rights (ER).

- 11 Bank Biayai Proyek Tol Serang-Panimbang Rp6 Triliun

- PTPP Hingga Mei 2021 Raih Kontrak Baru Rp6,7 Triliun

- Rilis Rapid Fire, MNC Studios Milik Hary Tanoe Gandeng Pengembang Game Korea

- Anies Baswedan Tunggu Titah Jokowi untuk Tarik Rem Darurat hingga Lockdown

- IPO Akhir Juni 2021, Era Graharealty Dapat Kode Saham IPAC

Anderson agreed to use his trade rights on his ER after the investment agreement was signed on January 31, 2013. On January 26, 2021, a closed transaction, referred to as the crossing of MPPA shares from Prime Star to Anderson, was completed at a price of Rp94 per share or Rp131.88 billion.

This figure is very far from the investment value of Anderson seven years ago. Anderson disbursed funds of up to US$300 million or more than Rp4.2 trillion (assuming an exchange rate of Rp14,000 per US dollar) via the interest-free equity related instrument.

Anderson’s investment value, which was predicted to be on the verge of burning down, is now beginning to see a ray of hope. This is based on the fact that MPPA’s stock has soared by hundreds of percent in the last two and a half months.

MPPA’s share price stood at Rp660 per share at the end of the first trading session on Wednesday, April 14 2021 or soared 602.13% compared to MPPA’s share price when the transaction closed itself on January 26 2021, amounting to Rp 94 per share.

That way, Anderson’s investment value also jumped from around Rp131.88 billion, now it has reached Rp925.95 billion. Nevertheless, this achievement is still very far from Anderson’s investment value at that time, around Rp 4.2 trillion.

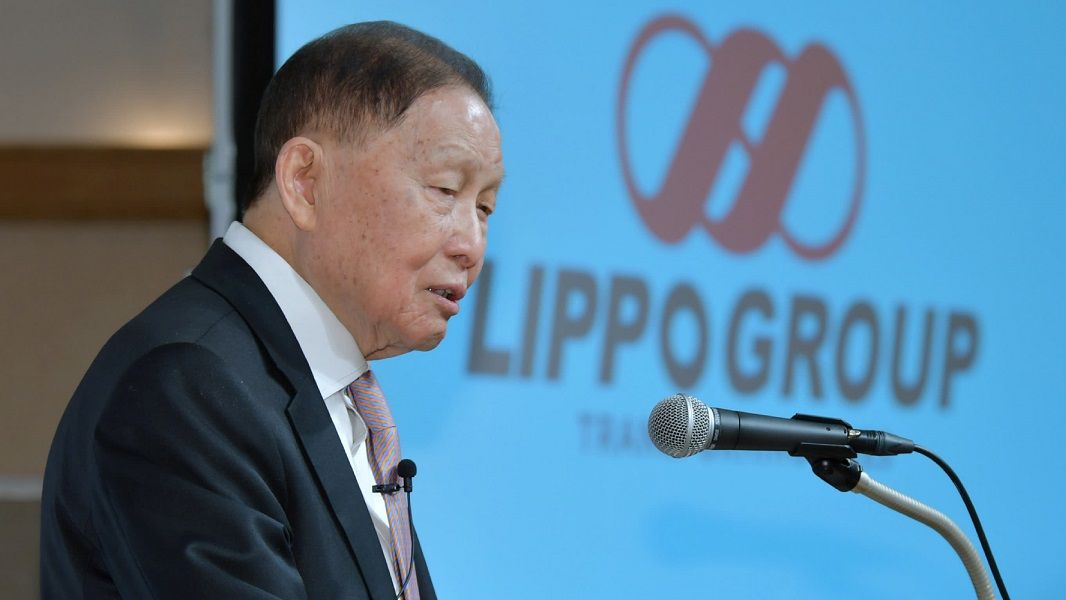

Recently, retail issuer Hypermart (MPPA), which is owned by the conglomerate Mochtar Riady, welcomed a new investor from Singapore, Watiga Trust Ltd. The entry of the investment fund management company coincided with the release of PT Multipolar Tbk’s 11.9% ownership of MPPA shares (MLPL).

Quoting the disclosure of information on the Indonesia Stock Exchange (IDX), Tuesday, April 13 2021, Watiga Trust bought 537,796,300 shares or 7.14% of the total shares of MPPA Hypermart retail owners at a price of Rp404 per share. Thus, Watiga Trust spent around Rp217.27 billion on this transaction.

Based on data collected by TrenAsia.com, Watiga Trust is a fund management company that is very involved in investing in Indonesia. This company was founded by Matthew Paul Richards, also known as Matt Richards, an international lawyer.

Reporter: Drean Muhyil Ihsan

Editor: Sukirno