New Chapter of Bank Indonesia Liquidity Assistance (Serial 2): Assorted Business of 30 BLBI Obligatory Conglomerate

JAKARTA – Like a team of ghost hunters, the Task Force for Handling State Claims and Bank Indonesia Liquidity Assistance (BLBI) is obliged to pursue assets worth Rp110.45 trillion that are still at large in the hands of 22 obligors and debtors. It is not an easy matter, more than 20 years since the 1998 […]

Industri

JAKARTA – Like a team of ghost hunters, the Task Force for Handling State Claims and Bank Indonesia Liquidity Assistance (BLBI) is obliged to pursue assets worth Rp110.45 trillion that are still at large in the hands of 22 obligors and debtors.

It is not an easy matter, more than 20 years since the 1998 economic crisis, the state has not been able to resolve the BLBI fund case. Until finally the government reaffirm by forming a Task Force in accordance with Presidential Decree (Keppres) Number 6 of 2021 which was signed on April 6, 2021.

Unmitigated, the BLBI Task Force is directly commanded by four coordinating ministers, two ministers and the attorney general, and the head of the Indonesian National Police. Of the total funds deposited by obligors, there are at least six types of claims.

Among them are in the form of loans of around Rp101 trillion, in the form of property of Rp8 trillion, and other forms in shares to foreign currency accounts.

- Modernland Realty Raup Marketing Sales Rp341 Miliar pada Kuartal I-2021

- Waskita Karya Raih Kontrak Pembangunan Jalan Perbatasan RI-Malaysia Rp225 Miliar

- Pengelola Hypermart (MPPA) Berpotensi Meraih Rp670,85 Miliar Lewat Private Placement

- Gandeng Visa Indonesia, MNC Bank Luncurkan MotionVisa

- Pemkot Tangerang Buka Posko Pengisian Oksigen Medis

The palace of the BLBI Task Force has been formed, the government has not yet disclosed the names of obligors who have been paid and those who have not.

Coordinating Minister for Political, Legal and Security Affairs (Menko Polhukam), Mahfud MD, said the government will soon release the names of BLBI obligors who have been paid off.

“I mentioned the 48 obligors in December 1998, the government made a disbursement of funds for BLBI, for 48 obligors. So, at that time some have been billed, some have been paid off, and so on. Later we will tell the public who is paid off,” Mahfud said during a press conference on Thursday, April 15, 2021.

Data from the Ministry of Finance in 2017 noted that state assets were still in the hands of 22 obligors. Although again, the government did not specify who the obligors were included in the 22 lists.

Apart from its latest civil status, TrenAsia.com compiles from various sources related to the varied and a number of conglomerates suspected of being involved in the BLBI megascandal:

1. Agus Anwar (Bank Pelita)

The President Director of Bank Pelita, Agus Anwar, was involved in the BLBI case which cost the state Rp1.9 trillion. Currently, it is reported that he fled to Singapore and is reported to have changed his nationality.

2. Hashim Djojohadikusumo (Bank Papan Sejahtera, Bank Pelita, and Istimarat)

The younger brother of the Minister of Defense, Prabowo Subianto, has long been known as a top national businessman. Several times, Hashim’s name has been included in the list of the 50 richest people in Indonesia.

Quoted from Forbes Magazine, Friday, December 4, 2020, the owner of Arsari Group occupies the 40th position of Indonesia’s richest people. The company is engaged in various sectors ranging from palm oil, mining, paper industry, and logistics services.

His wealth, as noted by Forbes, is US$800 million or around Rp11.2 trillion (exchange rate of Rp14,000 per US dollar). Initially, Hashim did an internship at his father’s company, Sumitro Djojohadikoesoemo, then he founded his first company, PT Era Persada, which was later sold in 1998.

Now, his companies have merged into Arsari Group. In the context of BLBI, Hasyim has never dealt with the law. Although his name always appears in the list of BLBI recipients.

- Modernland Realty Raup Marketing Sales Rp341 Miliar pada Kuartal I-2021

- Waskita Karya Raih Kontrak Pembangunan Jalan Perbatasan RI-Malaysia Rp225 Miliar

- Pengelola Hypermart (MPPA) Berpotensi Meraih Rp670,85 Miliar Lewat Private Placement

- Gandeng Visa Indonesia, MNC Bank Luncurkan MotionVisa

- Pemkot Tangerang Buka Posko Pengisian Oksigen Medis

3. Samadikun Hartono (Bank Modern)

Samadikun Hartono is a convict in the BLBI corruption case that cost the state Rp169.4 billion. After being on the run for 13 years, he was finally arrested in 2016.

On May 23, 2003, the Cassation Council found Samadikun Hartono guilty and sentenced to 4 years in prison. Samadikun was entangled in the BLBI case which cost more than Rp100 billion in state finances.

Samadikun Hartono is the owner of Modern Group. This company includes distributor Fujifilm, property developer Modernland, to retail company 7-Eleven which has gone out of business.

Through the Modern Group, Samadikun built the Modernland housing complex in Tangerang. Samadikun also owns a golf course, where Nasrudin was shot and then dragged Antasari Azhar to prison. Then Mayapada Hospital which was formerly known as Honoris Hospital.

In addition to the developer, Samadikun also established the Metropolis Mall. In the Tangerang area, Samadikun’s name was used as the name of the street in the housing estate along with his father Otje Honoris.

4. Kaharuddin Ongko (Bank Umum Nasional)

Kaharuddin Ongko is known as one of the owners of the Ongko Group which owns Omni Hospital through the issuer PT Sarana Meditama Metropolitan Tbk (SAME).

Kaharuddin is a former owner of PT Bank Umum Nasional, served as Deputy President Commissioner. In 2003, he was acquitted at the Central Jakarta District Court in the BLBI case that cost the state Rp6.7 trillion.

In fact, the total debt of the Ongko Group is around Rp2.48 trillion or the 15th largest obligor. The business group owned by Kaharudin Ongko consist of 23 companies and engaged in various fields, including finance, property, to services.

5. Ulung Bursa (Bank Lautan Berlian)

Ulung Bursa was caught in BLBI funds worth Rp424.65 billion.

6. Atang Latief (Bank Indonesia Raya)

Atang Latief is known to have a debt of Rp325 billion, but he has paid off Rp170 billion, bringing his remaining debt to the state to Rp155 billion.

From available information, Atang’s shares are spread across a number of companies such as PT Bina Multi Finance (BMF), PT Cipta Selera Murni (CSEM), PT Cipta Swadaya Murni (CSWM), and PT Ladang Karya Selaras Buana (LKSB).

7. Lidia Muchtar (Bank Tamara)

Just like her father Atang Latief, Lidia Muchtar also enjoyed BLBI funds. Although there is not much information about her, Lidia is known to have taken on a debt of Rp189.039 billion.

8. Omar Putihrai (Bank Tamara)

In 2011, Omar Putihrai was declared to have paid off debts related to BLBI funds amounting to Rp175.05 billion.

9. Adisaputra Januardy and James Januardy (Bank Namura Yasonta)

As bank owners, both of them are reported to have paid off their debt repayment obligations of Rp303 million plus assets of Rp87.3 billion.

10. Marimutu Sinivasan (Bank Putera Multikarsa)

Marimutu Sinivasan is the founder of the Texmaco Group, the king of the textile industry from the 1980s to the 1990s. Most recently, the Supreme Audit Agency (BPK) noted that the value of Texmaco’s assets reached trillions, including its subsidiaries.

According to IBRA records, five companies under Texmaco, namely PT Jaya Perkasa Engineering, PT Bina Prima Perdana, PT Texmaco Jaya Tbk, PT Wastra Indah, and PT Polysindo Eka Perkasa (now known as PT Asia Pacific Fibers Tbk).

The total claim rights in Texmaco-owned companies reached Rp36 trillion. This amount includes rupiah-denominated receivables of Rp16.25 trillion, and US dollar receivables of US$2.21 billion.

11. Santosa Sumali (Bank Metropolitan and Bank Bahari)

Santosa Sumali is known to have debts related to BLBI worth Rp286 billion.

12. Fadel Muhammad (Bank Intan)

At the inauguration of 10 leaders of the People’s Consultative Assembly (MPR) for the 2019-2024 period, Fadel Muhammad reported his wealth. In the May 31 2019 report, he stated that he owned 8 lands and buildings worth Rp41.74 billion spread across South Jakarta and Bogor.

Other movable assets amounted to Rp928.95 million, then securities to Rp70.11 billion. Cash and cash equivalents worth Rp1.02 billion. Thus, his total assets reached Rp113.81 billion.

The reports included his tenure as Governor of Gorontalo 2007-2012 (July 3, 2006), Minister of Marine Affairs and Fisheries for the period 2009-2014 (30 November 2009, 5 January 2012. Then, members of the House of Representatives for the 2014-2019 period (20 October 2014, 31 December 2017, 31 December 2018), as well as candidates for Council of Regional Representatives members (31 May 2019).

- Modernland Realty Raup Marketing Sales Rp341 Miliar pada Kuartal I-2021

- Waskita Karya Raih Kontrak Pembangunan Jalan Perbatasan RI-Malaysia Rp225 Miliar

- Pengelola Hypermart (MPPA) Berpotensi Meraih Rp670,85 Miliar Lewat Private Placement

- Gandeng Visa Indonesia, MNC Bank Luncurkan MotionVisa

- Pemkot Tangerang Buka Posko Pengisian Oksigen Medis

13. Baringin MH Panggabean and Joseph Januardy (Bank Namura Internusa)

The information that was obtained was that Baringin had been arrested in 2008. Meanwhile, together with Joseph Januardy, the two received BLBI funds worth Rp158.9 billion.

14. Trijono Gondokusumo (Bank Putera Surya Perkasa)

Having debts worth Rp2.9 trillion, Tijono is one of the most wanted obligors by the government.

15. Hengky Wijaya (Bank Tata)

16. Tony Tanjung (Bank Tata)

17. I Gde Dermawan (Bank Aken)

18. Made Sudiarta (Bank Aken)

19. Tarunojo Nusa Wijaya (Bank Umum Servitia)

20. David Nusa Wijaya (Bank Umum Servitia)

David Nusa Wijaya was sentenced to prison for 4 years and a fine of Rp30 million, with the provision that if the fine was not paid, it would be replaced with imprisonment for 6 months.

In addition, the convict was also sentenced to pay compensation to the state amounting to Rp1.29 trillion. In March 2021, David’s assets were auctioned and raised funds worth Rp3.60 billion and handed over to the executor of the West Jakarta District Attorney’s Office to be deposited to the state as a return for state financial losses.

21. Liem Sioe Liong/Anthoni Salim/Salim Group (Bank Central Asia)

Liem Sioe Liong or Sudono Salim is better known as Om Liem. He is the founder of the Salim Group which is now succeeded by his son, Anthoni Salim.

Anthoni is one of the most famous conglomerates in Indonesia. In its heyday, the Salim Group almost had businesses in all industrial sectors, ranging from businesses in the banking sector, food industry, building materials, retail, to automotive.

One of them was PT Bank Central Asia Tbk (BBCA) or BCA, but in the 1998 crisis he was forced to sell the company to the Djarum Group formed by the Hartono duo, Robert Budi Hartono and Bambang Hartono.

- Modernland Realty Raup Marketing Sales Rp341 Miliar pada Kuartal I-2021

- Waskita Karya Raih Kontrak Pembangunan Jalan Perbatasan RI-Malaysia Rp225 Miliar

- Pengelola Hypermart (MPPA) Berpotensi Meraih Rp670,85 Miliar Lewat Private Placement

- Gandeng Visa Indonesia, MNC Bank Luncurkan MotionVisa

- Pemkot Tangerang Buka Posko Pengisian Oksigen Medis

However, the loss of BCA did not make him disappear from the circulation of the richest person in Indonesia. The proof is, until now the Salim Group is still a big business empire that owns Bogasari, Indofood, oil palm plantations, Indomobil, Sari Roti to Indomaret which are now widely spread throughout Indonesia and several countries in Asia to Africa.

In 2017, the Salim Group again explored business in the banking world. To be precise, in January 2017, the Salim Group bought 29.02% shares of PT Bank Ina Perdana Tbk (BINA) through the NS Financials Fund for 10.58% shares and through the NS Asean Financial Fund for 18.44%.

In the BINA information disclosure on January 10, 2020, the Salim Group officially became the ultimate shareholder or the last controlling shareholder (PSPT) of the company together with the owner of Bali United (PT Bali Bintang Sejahtera Tbk/BOLA), Pieter Tanuri.

22. Mohammad “Bob” Hasan (National Commercial Bank)

This entrepreneur and former Minister of Industry and Trade in the Soeharto Era has a long track record in the Indonesian business world. Bob, who passed away on March 31, 2020, was known as the King of the Jungle because of his business empire in the timber industry.

Under the Nusamba Group (Nusa Ampera Bhakti), Bob has core businesses in the timber, plantation, and aviation sectors and has more than 20 subsidiaries. Apart from that, Bob Hasan holds four business groups: Pasopati Group, Bank Umum Nasonal Group, Bank Duta, Kalimanis Group, and Hasfarm Group.

With so many companies, it is estimated that Bob Hasan controlled around 160 companies in various sectors that were successful during the Soeharto era.

23. Sjamsul Nursalim (Bank Dagang Nasional Indonesia/BDNI)

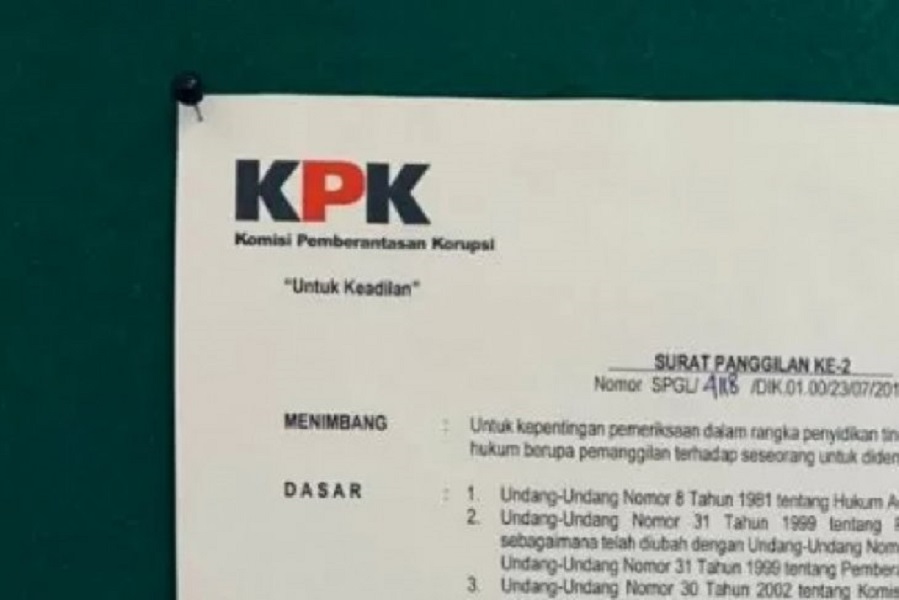

The Corruption Eradication Commission (KPK) officially named Samsjul Nursalim and his wife Itjih Nursalim as suspects in the BLBI case that cost the state up to Rp4.58 trillion.

Based on Forbes data at the end of 2020, Sjamsul’s wealth had shrunk from US$990 million or Rp13.99 trillion to US$788 million or Rp10.67 trillion. With this financial position, Sjamsul’s ranking in the ranks of Indonesia’s richest people according to Forbes Magazine 2020 also slipped to number 35 from the previous 33.

Sjamsul’s wealth was obtained from a number of businesses in the country, especially in the property, coal and retail sectors. Sjamsul Nursalim is the owner of PT Gajah Tunggal Tbk (GJTL), which has a market share of 30% in Southeast Asia, Africa and the Middle East.

Meanwhile, he also owns shares in PT Mitra Adiperkasa Tbk (MAPI), a company that operates brands, such as Zara, Topshop, Steve Madden, Mango, Mark Spencer, Adidas, and a number of other foreign brands.

24. Sudwikatmono (Bank Surya)

The cousin of Suharto has served as PT Indocement Tunggal Prakarsa Tbk (INTP), PT Indofood Sukses Makmur Tbk (INDF), and PT Bogasari Flour Mills. He is known as the boss of Subentra Group and Golden Truly Group.

Apart from these two groups, Dwi has also been involved in the Tasik Madu Group which is engaged in shipping. In the film sector, apart from becoming a film distributor and building the Cineplex network, Dwi also plans to build a film studio like the one in Hollywood. In 1972, he became chairman of the association of importers of mandarin films.

On March 1, 1996, he founded PT Indika Inti Mandiri, which among others oversees Net Visi Media. Dwi’s children are also involved in the business world. His daughter used to be known in the Planet Hollywood franchise. Meanwhile, his son, Agus Lasmono, is in the coal, oil and gas business at PT Indika Energy Tbk (INDY).

25. Ibrahim Risjad (Bank Risjad Salim International)

Risjad together with Sudwikatmono and his superior Sudono Salim, they then set up a limited liability company. Their company was named PT Waringin Kencana. Still together with his previous business partner and added a new member named Djuhar Susanto, Risjad also founded PT Indocement Tunggal Perkasa Tbk (INTP). From here, the four businessmen are often given the nickname “The Gang of Four”.

After Waringin Kencana, they founded a cement company, then established PT Bogasari which was then under the auspices of PT Indofood Sukses Makmur Tbk (INDF). Their products cover the basic needs of society.

Some of the business sectors managed by Risjadson are the property sector such as Park Royal Apartment, then a cosmetics company called PT Ayu Agung, and banking, namely Bank Windu Kentjana.

In other sectors, he owns Takengon Pulp and Paper and the oil palm plantation, PT Satya Agung.

26. Bambang Trihatmodjo (Bank Alfa)

Bambang is perhaps one of Suharto’s most famous children. Not only his business, his household is also often highlighted. Mayangsari’s famous husband is also known to inherit his father’s various business.

Bambang is the founder of Bimantara Citra which is now PT Global Mediacom Tbk (BMTR), now controlled by conglomerate Hary Tanoesoedibjo. In 1981, Bambang collaborated with four of his friends, namely Mochamad Tachril, Rosano Barack, Indra Rukmana, and Peter F. Gontha to pioneer Bimantara.

Bambang Trihatmodjo’s business group has shares in 96 companies. Among the 96 subsidiaries, each is divided into 35 subsidiary companies and more than 50% of the capital comes from Bimantara.

Then 48 other companies are categorized as affiliate companies whose shares in Bimantara are less than 50%. While the remaining 13 are considered other companies whose shares in Bimantara are only around 10% to 20%.

- Modernland Realty Raup Marketing Sales Rp341 Miliar pada Kuartal I-2021

- Waskita Karya Raih Kontrak Pembangunan Jalan Perbatasan RI-Malaysia Rp225 Miliar

- Pengelola Hypermart (MPPA) Berpotensi Meraih Rp670,85 Miliar Lewat Private Placement

- Gandeng Visa Indonesia, MNC Bank Luncurkan MotionVisa

- Pemkot Tangerang Buka Posko Pengisian Oksigen Medis

One of the companies owned by the Cendana family is incorporated in several sub-holdings and Bimantara is the holding company. Bambang also ventured into the banking business by establishing Bank Andromeda.

At that time, Bimantara’s types of business activities included chemicals with assets of Rp666.7 billion, agribusiness consisting of timber companies in Balikpapan and Nestle (Rp957.7 billion).

Next are companies in finance and insurance (Rp105.7 billion), media and communication (Rp382.6 billion), mining and energy (Rp234.9 billion), pharmaceuticals (Rp10 billion), real estate and property (Rp881.8 billion), automotive (Rp148.6 billion), and air transportation (Rp120.2 billion).

Several large companies known to be under the Bimantara Group include television station RCTI, PT Plaza Indonesia Realty Tbk (PLIN), Asriland, PT Indonesia Air Transport Tbk (IATA), and PT Chandra Asri Petrochemical Tbk (TPIA). Bambang Trihatmodjo also established another holding company, PT Bumi Kusuma Prima.

Several Bimantara companies belonging to this group of companies include PT Gelatindo Multi Graha (capsule shell manufacturer), PT Lima Satria Nirwana (Mercedes-Benz agency), and PT Citra Auto Nusantara (Ford).

27. Suryadi/Subandi Tanuwidjaja (Bank Sino)

28. Ciputra Family (Bank Ciputra)

The owner of the property giant, Ciputra died on November 27, 2019. After his death, Ciputra’s business continues to thrive, especially in the property sector such as the Jaya Group, Metropolitan Group, and Ciputra Group through PT Ciputra Development Tbk (CTRA).

Together with Sudono Salim (Liem Soe Liong), Sudwikatmono, Budi Brasali and Ibrahim Risjad, Ciputra founded the Metropolitan Group. The company is building the luxury housing estates Pondok Indah and Kota Mandiri Bumi Serpong Damai (BSDE).

At that time, Ciputra served as president director at Jaya Group and at Metropolitan Group as president commissioner. Until finally Ciputra founded a family company group, Ciputra Group.

29. Aldo Brasali (Bank Orient)

The late Aldo Putra Brasali was the son of tycoon Budi Brasali or Lie Twan Hong. Initially, Budi founded the Brasali Group in 1991 which is engaged in the business of computers, electricity, industrial real estate, finance, air conditioning industry, to the chemical industry.

After Budi’s death in 2006, the business of the Brasali Group grew rapidly under his son Iwan Putra Brasali and Aldo Putra Brasali.

One of them is the property business such as Brasali Realty, Pede Realty, Pondok Indah Group, to the Metropolitan Group. Satrio Tower, Mercure Bali Legian, Batavia Tower, Golfhill Terrace Apartment, Batavia, Ibis Arcadia, Ibis Mangga Dua, Ibis Rajawali, Ibis Cikarang.

30. Sofjan Wanandi (Bank Danahutama)

The owner of the Santini Group was once again widely discussed because he bought shares of the club participating in League One or the third division of the English League, Tranmere Rovers. The Santini Group was formed by Sofjan Wanandi in 1994. It is a holding company from Indonesia that has businesses in the fields of automotive equipment, infrastructure, natural resources, property development, and services.

He started his own business empire in 1980, at the beginning of his business he opened an automotive components business under the name PT Anugerah Daya Laksana. Together with other members of the Wanandi family, Sofjan’s business was merged into a group with a new company name, namely PT Sapta Panji Manggala.

The name of the business group was later changed to Gemala Group in 1987. This business group also developed to establish cooperation with Yuasa Corporation of Japan. Since then, Gemala Group’s products have been marketed in other countries.

Gemala Group has achieved success for success, even in 2016, the Globeasia.com page included the name of Sofjan Wanandi as one of the conglomerates in Indonesia.

The page states that Sofjan is at number 73 on the list of the 150 Richest People in Indonesia. He is known to have a wealth of up to US$610 million or Rp8.9 trillion. (SKO)

This article is the last part of special report series, the previous article entitled “New Chapter of Bank Indonesia Liquidity Assistance (Serial 1): Long History of State Money Looted”

Writer: Ananda Astri Dianka

Editor: Sukirno