Profit and Income of Industrial Estate Issuers in Indonesia Slumps

- JAKARTA – The government continues to accelerate the development of industrial estates in the country in order to attract investors, both domestic and internati

Insight Langit Biru

JAKARTA – The Indonesian government continues to accelerate the development of industrial estates in the country in order to attract investors, both domestic and international. It also aims to open up opportunities for business relocation to enter Indonesia.

At the beginning of the year, the Ministry of Investment/Investment Coordinating Board (BKPM) reported that there were 122 companies that had the potential to move their business to Indonesia. The total investment reached US$40.5 billion or equivalent to Rp587.2 trillion (exchange rate of Rp14,500 per US dollar).

As for the first half of this year, the realization of investment entering Indonesia reached Rp442.8 trillion. This amount is almost half of the targeted figure, which is Rp900 trillion. The largest investment flow of Rp60.7 trillion was recorded to flow to the housing sector, industrial estates, and offices.

- Salacca Soft Candy, Permen Anti-Diabetes dari Kulit Salak

- Kinerja Keuangan Kuat, BRI Raih Peringkat IdAAA Outlook Stabil dari Pefindo

- Lagi Binomo Muncul dengan Situs Baru

However, what if you look at the current performance of a number of industrial estate issuers? During the first six months of 2021, several of them have released their financial reports on the Indonesia Stock Exchange (IDX).

DMAS

It was noted that PT Puradelta Lestari Tbk (DMAS) scored the most brilliant performance. This is because the Sinarmas group managed to record an increase in profit as well as revenue.

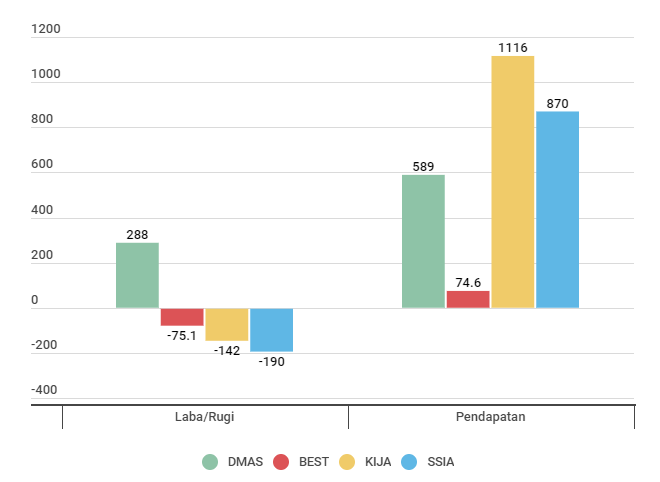

This company is superior to PT Bekasi Fajar Industrial Estate Tbk (BEST), PT Kawasan Industri Jababeka Tbk (KIJA), and Surya Semesta Internusa Tbk (SSIA). Instead of posting a profit, the three issuers actually incur losses, in fact their value has swelled compared to the previous period.

For DMAS itself, it recorded a net profit attributable to owners of the parent entity of Rp288 billion. This number shot up to 269% on an annual basis or year-on-year (yoy) from Rp78 billion per semester I-2020.

- Salacca Soft Candy, Permen Anti-Diabetes dari Kulit Salak

- Kinerja Keuangan Kuat, BRI Raih Peringkat IdAAA Outlook Stabil dari Pefindo

- Lagi Binomo Muncul dengan Situs Baru

In addition, revenue also managed to increase by 133.7% yoy to Rp589 billion. In the same period last year, DMAS still posted revenue of Rp252 billion.

This income was obtained from industrial sales of Rp436 billion, housing Rp100.6 billion, and commercial sales of Rp33.2 billion. Meanwhile, hotel and rental revenues contributed Rp5.7 billion and Rp3.7 billion, respectively.

In trading on Friday, September 3, 2021, DMAS shares closed up 3.24% by 6 points to the level of Rp191 per share. DMAS stock market capitalization reached Rp9.21 trillion with a negative yield of 16.49% in the last year.

BEST

Taking second place, PT Bekasi Fajar Industrial Estate Tbk (BEST) had to record a decline in performance in the first semester of 2021.

Net loss attributable to owners of the parent company reached Rp75.1 billion. This amount is much greater than the loss in the first semester of 2020 which amounted to Rp37.2 billion.

In terms of revenue, BEST's performance was also unsatisfactory, dropping to 51.2% year-on-year (yoy) per semester I-2021. Based on the company's financial reports, BEST's revenue fell from Rp153 billion in the first semester of 2020 to Rp74.6 billion in this period.

This is due to the absence of income from the land sales post. In fact, in the same period last year, land sales still contributed to revenue of up to Rp66.8 billion. In addition, hotel revenues also decreased from Rp4.3 billion to Rp3 billion per semester I-2021.

Another decrease was also experienced by other income which amounted to Rp13.5 billion from the previous Rp24.5 billion per semester I-2020. The income that only decreased slightly was maintenance fees, service charges, water and rent of Rp58 billion from the previous Rp58.1 billion per semester I-2020.

KIJA

Industrial estate company, PT Jababeka Tbk (KIJA) is in the third place due the net loss recorded is greater than BEST, which is Rp142 billion per semester I-2021. This loss swelled compared to the net loss per semester I-2020 of Rp84.2 billion.

Jababeka's Corporate Secretary, Muljadi Suganda, said the main cause of this loss was the movement of foreign exchange differences. “The company posted a foreign exchange loss of Rp112.5 billion in the first semester of 2021. Meanwhile, the foreign exchange loss in the same period in 2020 was Rp66.1 billion," he said in an official statement received on Saturday, August 28, 2021.

The company's total revenue also decreased in this period, which was Rp1.1 trillion. This figure decreased by 11% year-on-year (yoy) compared to the first semester of 2020 of Rp1.25 trillion.

- Salacca Soft Candy, Permen Anti-Diabetes dari Kulit Salak

- Kinerja Keuangan Kuat, BRI Raih Peringkat IdAAA Outlook Stabil dari Pefindo

- Lagi Binomo Muncul dengan Situs Baru

This was due to KIJA's Pilar Land Development & Property business unit, which experienced a 34% decline in revenue yoy to Rp436.3 billion in semester I-2021. In the same period last year, this business revenue was recorded at Rp663.1 billion.

Muljadi said that the decline in revenue was mainly due to the decline in sales of mature industrial products and land with factory buildings, to Rp217.5 billion and Rp19.1 billion, respectively.

Meanwhile, sales of mature land from Cikarang and Kendal amounted to Rp31.6 billion and Rp495.4 billion, respectively, in the first semester of 2021.

In trading on Friday, September 3, 2021, KIJA shares closed down 5.92% by 10 points to the level of Rp159 per share. KIJA's stock market capitalization is Rp3.31 trillion.

SSIA

Finally, PT Surya Semesta Internusa Tbk (SSIA) had to swallow the bitter pill because the losses incurred were the largest among the three previous issuers. SSIA's loss per semester I-2021 is Rp190 billion. This number swelled compared to the first semester of 2020 which amounted to Rp122 billion.

Meanwhile, the company's revenue also fell by 40.5% year-on-year (yoy) to Rp870 billion. Previously, as of the first semester of 2020, the company still posted revenues of up to Rp1.46 trillion.

In this case, construction services are the main factor in the decline in the company's revenue. Because, per semester I-2020 this post only contributed Rp648 billion. In fact, in the same period last year construction services generated revenues of up to Rp1.13 trillion.

In addition, revenue from the hotel business also shrank from Rp152 billion to Rp69 billion per semester I-2021. The rental, parking, maintenance and utility services amounted to Rp146 billion, the rest from industrial estate land of Rp5.7 billion.

In trading on Friday, September 3, 2021, SSIA's shares closed up 0.83% by 4 points to the level of Rp486 per share. SSIA's stock market capitalization was recorded at Rp2.29 trillion.

Performance Chart of Industrial Estate Issuers

Author: Aprilia Ciptaning

Editor: Amirudin Zuhri