The Effect of the Rising US Inflation for Indonesia

The global market which is still shrouded in uncertainty has again received a signal from the United States (US) with the release of the consumer price index in May 2021. What are the effects of these signals on the Indonesian market? Inflation in the US Consumer prices in the United States surged in May 2021 […]

Insight Langit Biru

The global market which is still shrouded in uncertainty has again received a signal from the United States (US) with the release of the consumer price index in May 2021.

What are the effects of these signals on the Indonesian market?

Inflation in the US

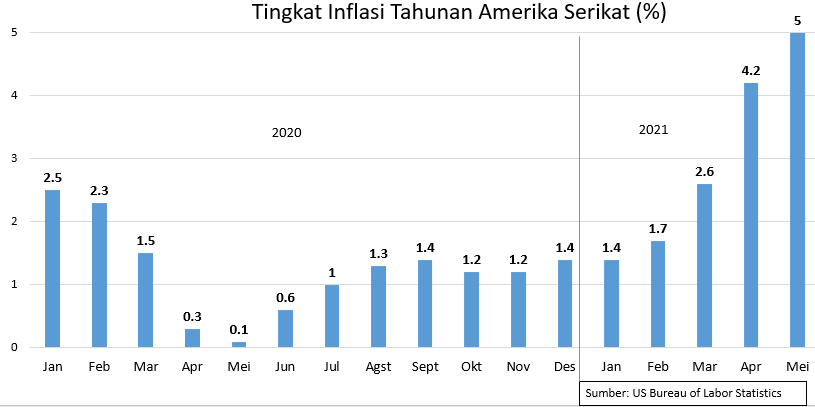

Consumer prices in the United States surged in May 2021 with the inflation rate rising to 5% for the 12 months ending in May 2021.

The inflation rate in May 2021 was higher than the previous month which was 4.2%. The inflation rate in May was above the market forecast of 4.7%. The inflation rate in May this year is the highest inflation rate for 12 years after inflation in August 2008 which recorded a record 5.4%.

The US Bureau of Labor Statistics noted that this increase in inflation has been a trend every month since January 2021. The 5% inflation rate was driven by the rise of energy prices and used cars.

US Bond Yields Rise

After the announcement of the consumer price index in May in the US, the yield on US bonds with a tenor of 2 to 30 years strengthened. The 10-year US bond on June 10, 2021 fell 5.5 basis points (bp) from the previous day to 1.437%.

The sharp decline in the 10-year bond yield started on June 7 when the market projected that US inflation in May would be higher than the previous month.

World Government Bond data shows that the yield on 10-year US bonds continued to strengthen until June 11 to 1.434%. Yield gains were greatest for long tenor bonds, namely 10 years, 20 years and 30 years.

Threats for Indonesia

Previously, Minister of Finance, Sri Mulyani, said that the estimated inflation in the US could create a drag effect, volatility and uncertainty in the financial sector, as well as the dynamics of global capital flows similar to during a taper tantrum.

The taper tantrum that occurred in 2013 was the effect of expectations for the normalization of US monetary policy which prompted a reversal of capital flows from developing countries.

The Governor of Bank Indonesia, Perry Warjiyo, anticipates that the US central bank (The Fed) will reduce the stimulus (tapering off) by debt.

Bank Indonesia will continue to take into account the possibility that next year the Fed will begin to change its monetary policy by reducing liquidity intervention.

The US will probably tighten and raise interest rates. The Fed Funds Rate target is currently 0.00%-0.25%.

How are the Conditions of Rupiah and Bonds?

Rupiah on June 10, 2021 strengthened. Bloomberg data shows that rupiah was at the level of Rp14,248 per US dollar, while the previous day was Rp14,255.

Meanwhile, Bank Indonesia’s JISDOR exchange rate showed rupiah at the level of Rp14,240 per US dollar on June 10, 2021, strengthening from the previous day’s position of Rp14,262. Since June 4, 2021, the rupiah has continued to strengthen.

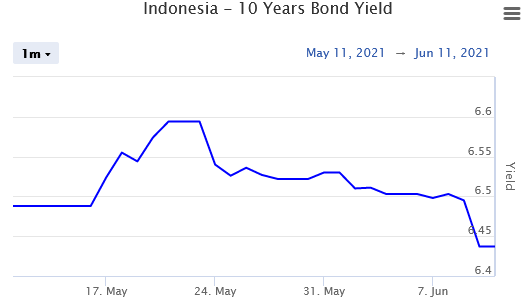

The yield on Indonesian bonds with a tenor of 10 years. Source: World Government Bonds.

Meanwhile, the yield on Indonesian 10-year bonds on June 10, 2021 rose 5.8 bp from the previous day to 6.437%. In the span of 1 month, Indonesia’s 10-year bonds have strengthened 5.1 bps with a trend of strengthening trend since May 21, 2021.

Based on data from World Government Bonds, during the last 1 month, the largest strengthening of Indonesian bond yields occurred in short tenors, namely 3 years and 1 year.

Consumers are More Optimistic

From the Consumer Survey held by Bank Indonesia, the Consumer Confidence Index in May 2021 was 104.4, an increase from the previous month of 101.5.

The CCI is a reflection of consumer optimism about economic conditions. If the index is above 100 it means optimistic, while below 100 means pessimistic.

The increase in CCI in May 2021 was driven by improved consumer perceptions of current economic conditions. This is reflected in the Current Economic Condition Index in May 2021 which increased to 86.8 from 80.3 the previous month. However, it should be noted that IKE is still in the pessimistic area.

Improved consumer perceptions of current economic conditions are driven by improved perceptions of job availability, income, and the timeliness of purchasing durable goods.

Meanwhile, consumer expectations for future economic conditions in May 2021 amounted to 122.1, slightly down from 122.6 in the previous month. Expectations of job availability increased, while expectations of business activity and income were quite strong, although lower than the previous month.

Writer: Gloria Natalia Dolorosa